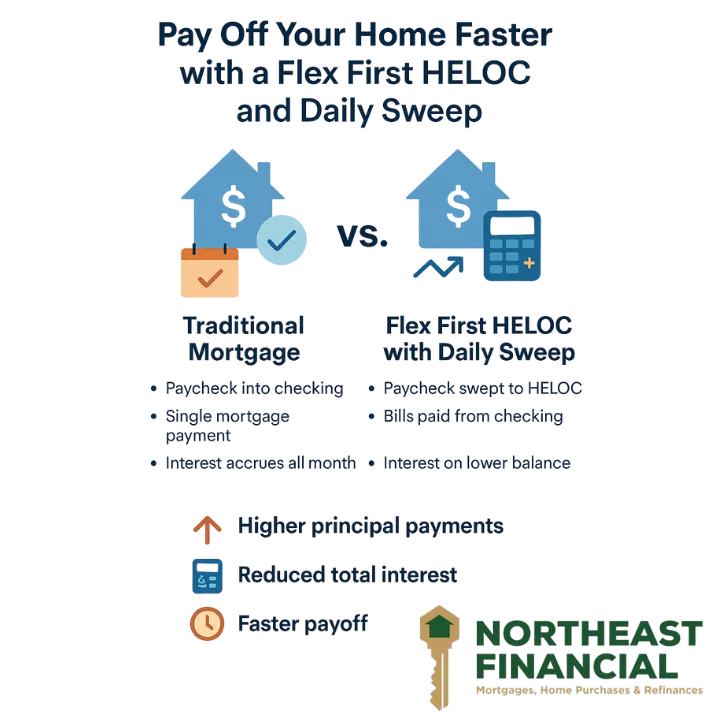

Pay Off Your Home Faster with a Flex First HELOC and Daily Sweep

Many homeowners feel stuck with a traditional mortgage: fixed monthly payments, interest piling up, and little flexibility. But what if your everyday income could actively work to pay down your home faster? That’s the idea behind the Flex First HELOC with a daily sweep.

How It Works – Simple Explanation

A Flex First HELOC is a first-lien home equity line of credit that replaces your traditional mortgage. Instead of waiting for monthly payments to reduce your balance, this product links to your checking account and uses your cash flow to pay down your principal every day.

Here’s the breakdown:

Income applied immediately: Your paycheck and other deposits are swept daily to your HELOC, lowering your balance before interest is calculated.

Interest is daily, not monthly: Interest is calculated on your actual daily balance, so the more money you apply to your principal, the less interest you pay.

Expenses covered automatically: When you spend from your checking account, the money is pulled from your HELOC. No overdraft.

Principal reduction accelerates payoff: Every leftover dollar after expenses goes directly to reducing your balance.

Real-Life Example - Let’s see this in action:

How it works:

You deposit your paycheck → immediately reduces your HELOC balance.

You pay your daily expenses from your linked account → the HELOC covers it automatically.

Any leftover cash after expenses → goes straight to principal, reducing your balance faster.

This small change—putting your income to work every day—can save tens of thousands in interest and cut your mortgage term by more than a decade.

Why It Matters

More principal, less interest: Your money works harder for you instead of sitting idle in checking.

Faster payoff: Pay off your home years sooner.

Flexibility: Access to your home equity if needed for emergencies.

Discipline pays off: Overspending can reduce benefits, and variable rates mean your interest may change.

With this approach, your income isn’t just covering monthly bills—it’s actively shrinking your mortgage every single day. The Flex First HELOC with daily sweep can turn years of interest into extra savings and help you become mortgage-free faster.