Turn High-Interest Debt Into Low-Interest Payments With Home Equity

Struggling with high-interest credit card debt? Learn how using home equity for debt consolidation can lower payments, reduce interest, and improve cash flow.

The Mortgage Learning Center

Struggling with high-interest credit card debt? Learn how using home equity for debt consolidation can lower payments, reduce interest, and improve cash flow.

Most homeowners choose 15, 20, or 30-year loans—but the right term depends on your life, not the headlines. Get clear, personalized guidance to make the best choice.

Explore the pros and cons of the 50-year mortgage — lower payments, slower equity growth, and what to consider before choosing this long-term loan option.

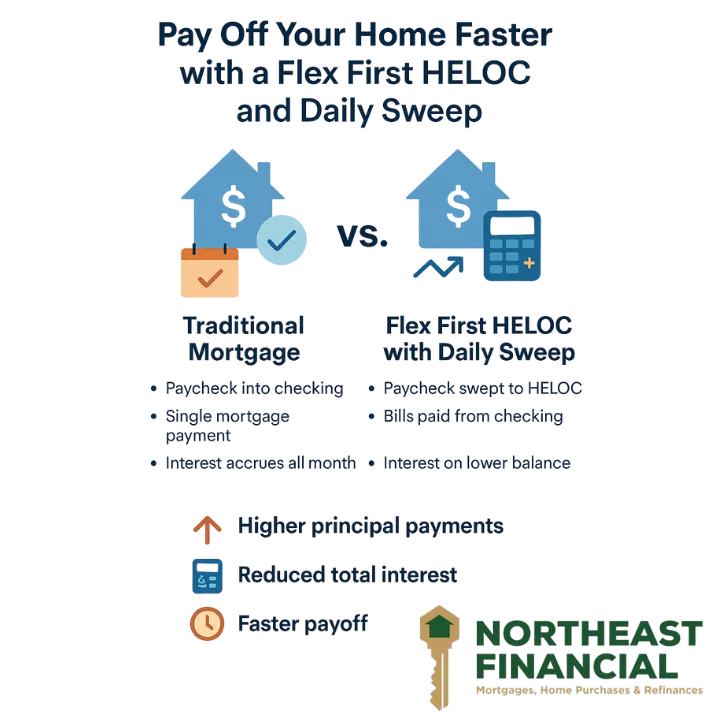

Many homeowners feel stuck with a traditional mortgage: fixed monthly payments, interest piling up, and little flexibility. But what if your everyday income could actively work to pay down your home faster? That’s the idea behind the Flex First HELOC with a daily sweep.

Fill in your information below to receive the guide. The Manual contains many options – including up to 100% financing (NO Money Down) on your home purchase.

117273, MORTGAGE BROKER ONLY, NOT A MORTGAGE LENDER OR MORTGAGE CORRESPONDENT LENDER.

117273, MORTGAGE BROKER ONLY, NOT A MORTGAGE LENDER OR MORTGAGE CORRESPONDENT LENDER.